Written by Lara

17 Jun 2021

*This article was updated in March 2025 with the latest information from the Swedish Tax Agency (Skatteverket).

Most of you have heard about the Swedish personal identity number or in Swedish, personnummer by now. If you’re wondering what it is, if you are eligible for it and how you can apply for it, you have landed on the right blog! Here is a step by step guide to make your application as smooth as possible.

What is a Swedish personal identity number?

The personal identity number is composed of your date of birth followed by a 4-digit number in the format: YYYYMMDD-XXXX.

You can get a Swedish personal identity number when you register in the Swedish population register ↗️ through the Swedish Tax Agency (Skatteverket). The personal identity number is widely used throughout your daily life, whether it is for memberships and subscriptions, opening a bank account, joining an insurance plan. It will enable you to get the same healthcare as Swedish citizens. You will also need that number to apply for a Swedish ID-card later on at the Tax Agency.

Can you apply for a Swedish personal identity number?

If you are an international student who have a residence permit, or are an EU/EEA-citizen, studying for at least one year, you should notify the Swedish Tax Agency about your move to Sweden.

For that, you need a registration certificate that you get from your university, in order to prove that you are enrolled as a student in Sweden. Consequently, it is not possible to apply before you have registered as a student at the beginning of the semester.

If you are an EU or an EEA citizen, you have the right to be in Sweden for 3 months. In order to register in the population register, you will need to move to and intend to live in Sweden for one year or more.

How can you apply?

To register, you will need to notify the Swedish Tax Agency of your move to Sweden ↗️ and it’s strongly recommended to do it already before you come to Sweden. This will save your time and allow you to see the documents you will need to provide in Sweden. So you know which documents you should bring to Sweden. Once you arrive in Sweden, all you need to do is visit one of the offices of the Swedish Tax Agency to complete your registration and for them to check your identity.

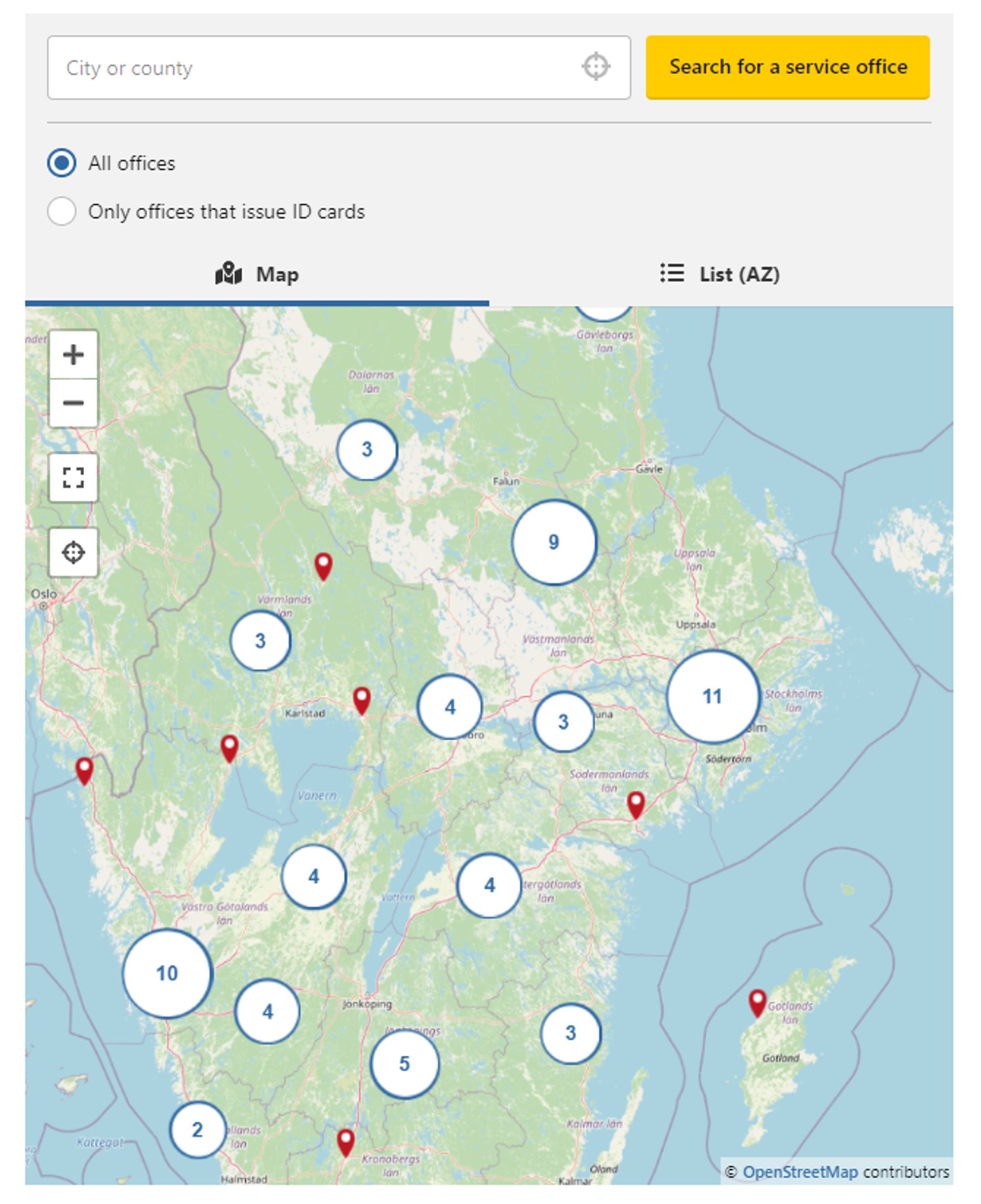

You should book an appointment at one of the Swedish Tax Agency’s selected service offices to for the identity check ↗️.

Upon your visit, make sure to bring with you all the documents required by the Swedish Tax Agency. It could include:

1. Passport, or if you are an EU-Citizen a national ID card is accepted

2. A letter of admission

3. Document showing that you are registered i.e., enrolled, on a recognized study programme in Sweden.

Depending on your situation, there are a few more documents you might need to provide:

1. Documents showing your civil status, e.g., marriage certificate. If you are unmarried, you do not need to show your civil status.

The following civil statuses exist: Unmarried, married or a registered partner, widow or widower, divorced.

Only original and clearly legible copies are accepted. You can show documents from the civil register in your home country.

2. If you have children under age 18 moving with you, you should provide documentation showing who is the parent/guardian of the child or children.

3. If you are an EU-citizen, an assurance that you have sufficient funds to support yourself during your stay

Check more details about the requested documents on the Swedish Tax Agency’s website ↗️. If you are moving with your family, there may be more documents you need to bring to Sweden.

If you haven’t notified the Swedish Tax Agency of your move to Sweden online, you can submit your notification when you have your appointment for an identity check.

Skatteverket will register which address you live at, where you were born and your citizenship, as well as your civil status, relationship to your spouse, and children under age 18. . You will also need to hand in the required documents. Again, it’s best to fill in the use the online service to make a notification of your move to Sweden ↗️ already before you visit the service office.

Steps for obtaining your personal number:

1. Log in to the Move to Sweden service.

2. Fill in the notification, upload the required documents, submit the notification.

3. Make an appointment for checking your identity documents.

4. Visit your closest office with your identity documents in original, and Residence Permit Card if you have one.

5. Wait to hear from the Swedish Tax Agency!

How can I get more information from Skatteverket?

Skatteverket hosts webinars ↗️ regularly throughout the year that will be really helpful to attend if you are coming to study in Sweden. In these webinars, they provide you with information that you need to know when you move to Sweden, live in Sweden and if you choose to move from Sweden. You will also get a basic introduction to Swedish tax. Additionally, you will get to ask questions directly to Skatteverket and get your doubts cleared.

In order to see the dates and register for the webinars, you can go on this link ↗️ , check the box for “Seminars in English” in the filter. The webinar series is called “New in Sweden– the population register and basic tax information”.

I have received my personal number. What now?

After getting your personal number, you sometimes need to inform your university! Check if that is the case on your university’s website.

As soon as you have your personnummer, take an appointment for applying for a Swedish ID card here ↗️. Be aware that not all their offices can issue ID cards. So follow the links on the webpage to check which office you should visit. You can use the ID card as proof of your age and identity at places such as pharmacies, banks or in shops.

If you move within Sweden, it is your legal duty to inform Skatteverket about your change of address. You will want to do this for your own sake as the address you register at the Swedish Tax Agency is your official address by default. Important letters from government agencies, hospitals, banks and so on will automatically be sent to the registered address.

Report any changes in your address online ↗️. It will only take some minutes!

If you are moving abroad for a year or more, you will also need to inform Skatteverket, in order to de-register from the Swedish population register↗️.