Written by Marta

20 Feb 2015

Did you know household finance is one of the trickiest areas of research? Yep, they totally lack data on how folks like you and I make their consumption & investment choices… Well, what you probably lack data about is just how much is enough to survive in Sweden. Guess what! That’s exactly what I’m gonna cover today.

Frankly, I feel challenged. It seems everyone has got their piece of the finance pie here: Gimmy just pulled out an awesome review of banking in Sweden, Francesca revealed a delicious secret on how to eat cheap, and Raghu released a double guide to living on a budget. As if that wasn’t enough, Mo’s advice on Makin’ Bank as a student in Sweden nearly exhausted the topic. What I’m left with here is quite possibly the least pleasant part: accounting. So below, you can find some extracts from the monthly statement of cash flows of Student Inc ., an SSE-listed company. The extracts are provided for purely educational purposes and do not follow IFRS requirements =)

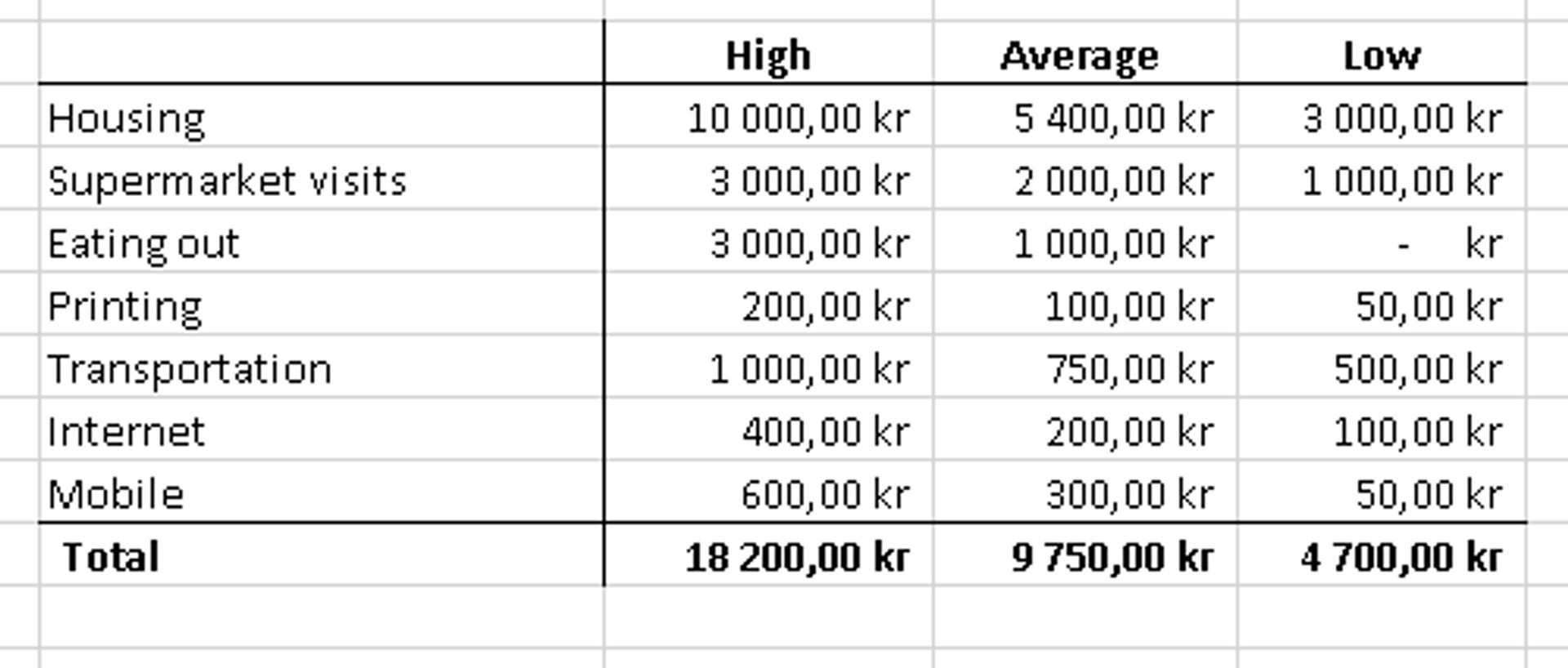

1. Operating Activities, or cash outflowers to keep you running

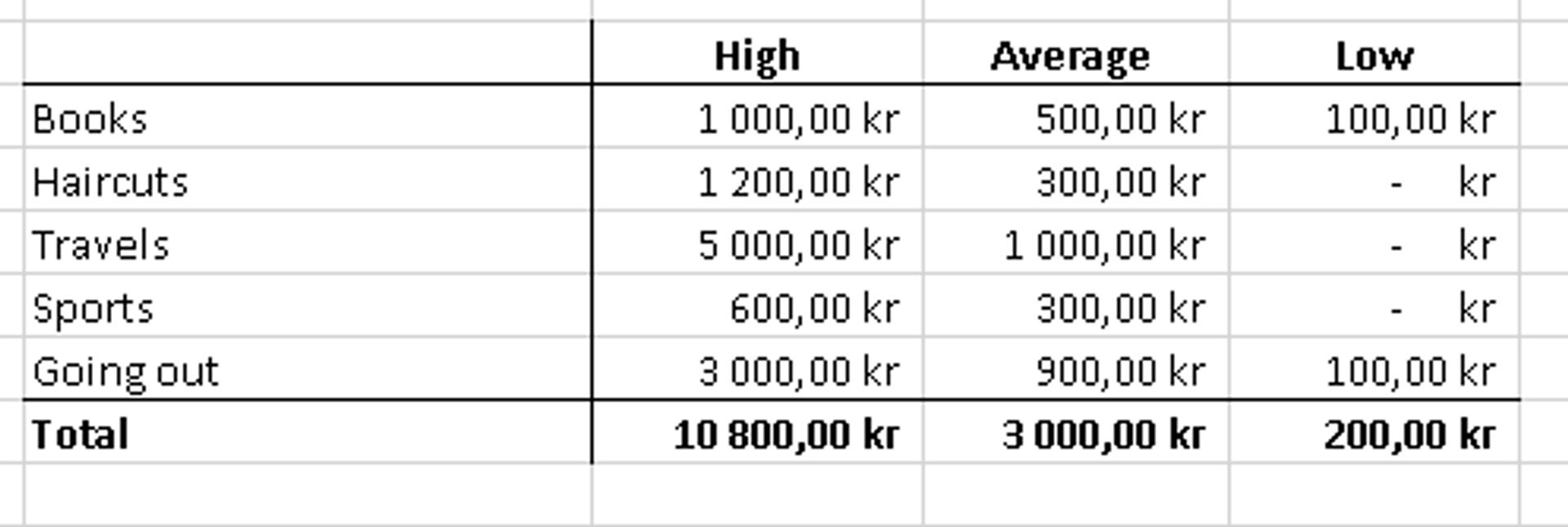

2. Investing Activities, or the necessary luxuries.

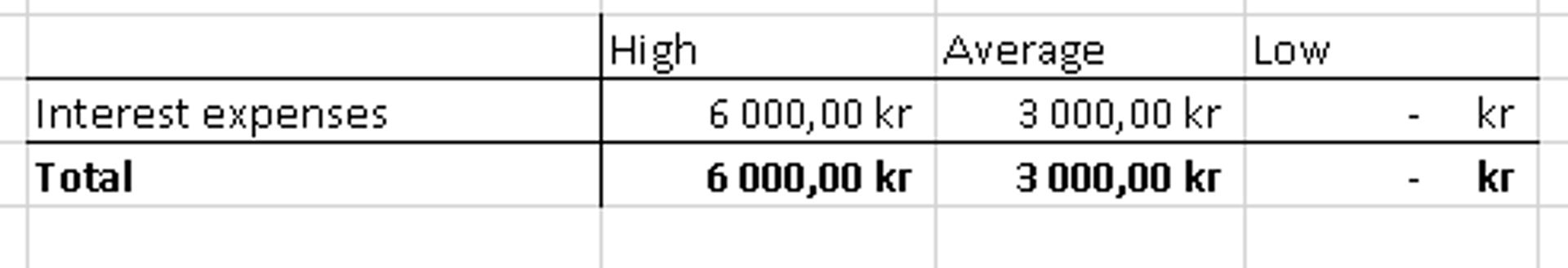

3. Financing activities, or watch out for debt!

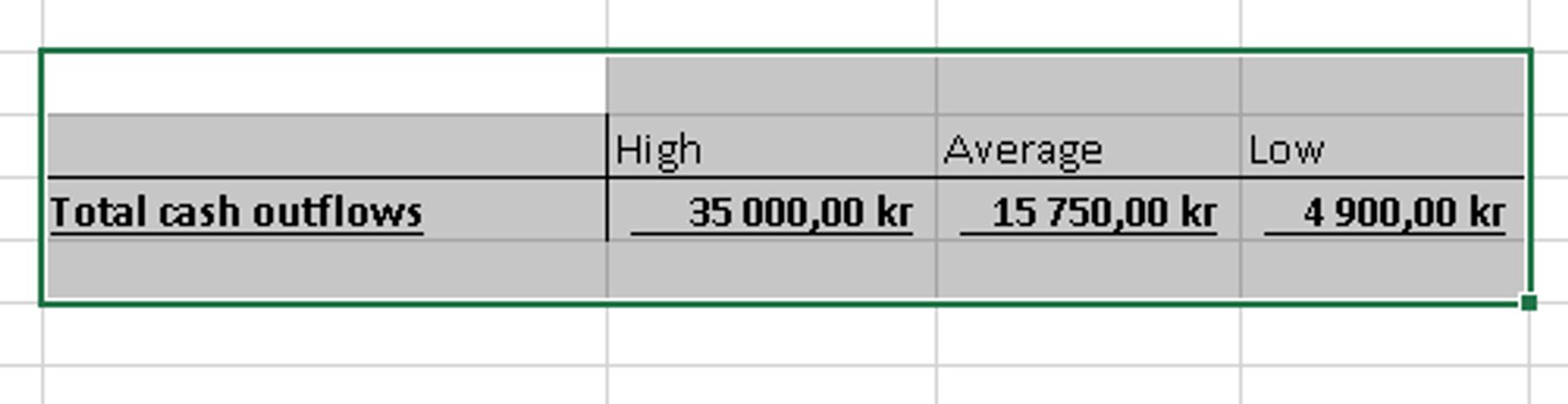

So in the end, how much cash outflows can you expect?

Now, I should include a disclaimer here. These are just rough estimates based on my own experience in Stockholm. Your personal habits can influence the numbers quite a bit. If you can’t stand Lidl, for example, you probably won’t make it under 1000 SEK/month on grocery shopping under low spending scenario. Cooking is also a crucial skill, or your eating out expenses could overrun rental costs. Buying every single textbook would also cost a fortune: 1200 SEK per book is not uncommon here. But hey, there are ways around it!

Yep, Sweden is expensive. But on the bright side, you can still survive on 5000 SEK (520 EUR) a month!

************

Source of the image here.